Fees and costs

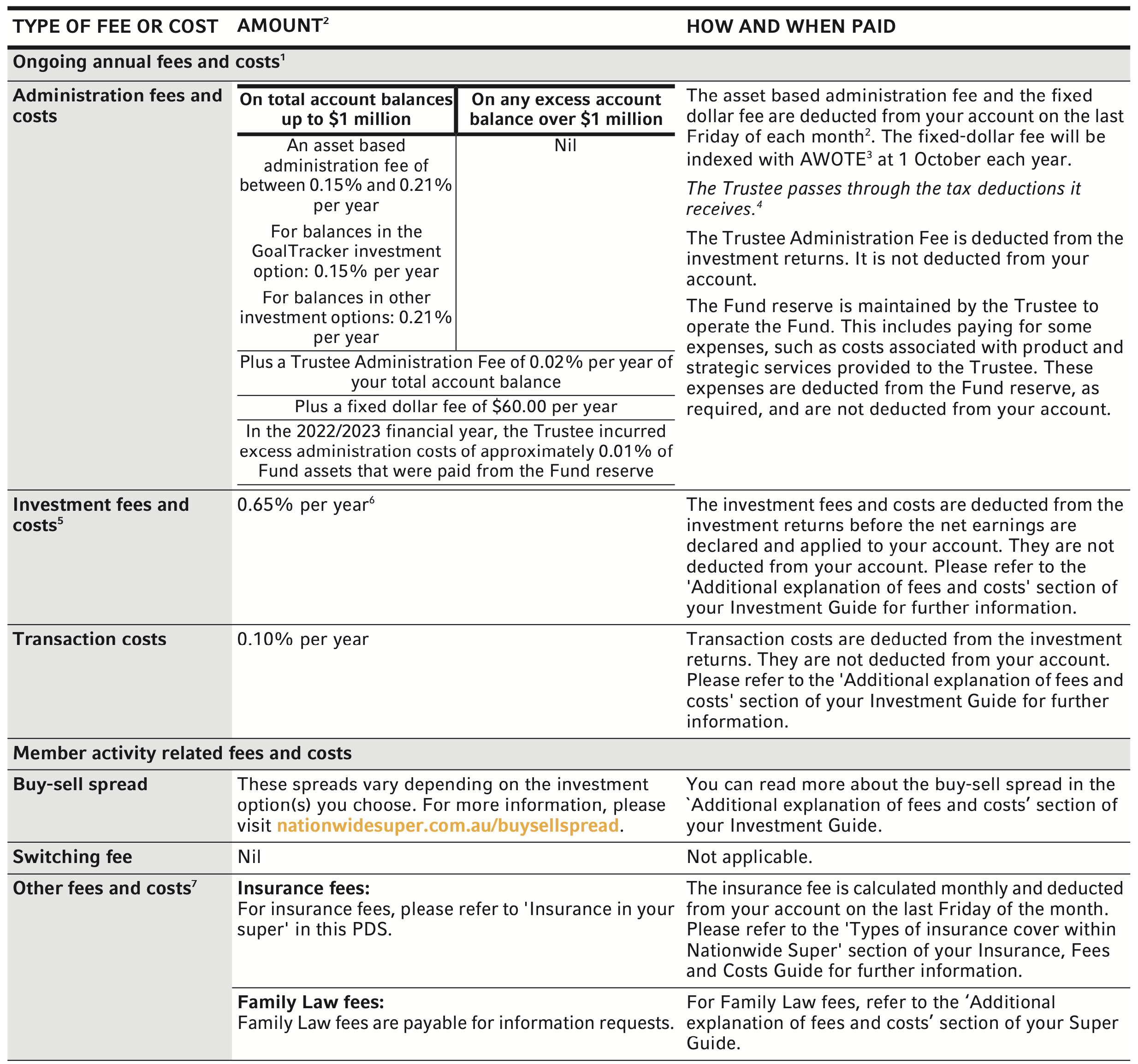

Fees and costs summary for Nationwide Super are set out below (effective 1 July 2025):

GoalTracker Investment option

You can also view the fees table in our PDF by clicking here

1. If your account balance for a product offered by the superannuation entity is less than $6,000 at the end of the entity’s income year, certain fees and costs charged to you in relation to administration and investment are capped at 3% of the account balance. Any amount charged in excess of that cap must be refunded.

2. The asset-based administration fee applies to the first $1 million of your total account balance and will depend on the investment option you are invested in. This fee may be charged in two parts and shows as separate transactions in your account. Please refer the ‘Additional explanation of fees and costs’ section of your Insurance, Fees and Costs Guide for further information on how the cap applies.

3. AWOTE means Average Weekly Ordinary Times Earnings.

4. As the Trustee passes through the tax deduction it receives, the deduction you will see for the fees described above is 0.1275% per year for the GoalTracker investment option, 0.1785% per year for the other investment options and $51.00 per year for the fixed dollar fee.

5. The investment fee varies according to the option you invest in. The quoted fee here is for the GoalTracker option.

6. Investment fees and costs includes an amount of 0.09% per year for performance fees. The calculation basis for this amount is set out under the ‘Additional explanation of fees and costs’ section of the Investment Guide.

7. Additional fees may apply. Refer to the ‘Additional explanation of fees and costs’ section of your Super Guide.

You should read the important information about ‘Fees and costs’ before making a decision – For Insurance and Administration Fees and Costs read the Insurance, Fees and Costs Guide. For Investment Fees and Costs read the ‘Additional explanation of fees and costs’ in the Investment Guide. For all other fee information, such as Family Law, Advice Fees and Fee definitions, read the ‘Additional explanation of fees and costs’ in the Super Guide.

This table provides an example of how the ongoing annual fees and costs for the GoalTracker option in this superannuation product can affect your superannuation investment over a one year period. You should use this table to compare this product with other superannuation products.

| EXAMPLE – GoalTracker investment option | BALANCE OF $50,000 | |

| Administration Fees and Costs | 0.17% p.a. Plus $60.00 p.a. Plus 0.01% (paid from the fund reserve)1 |

For every $50,000 you have in this option, you will be charged or have deducted from your investment $90.00 in administration fees and costs, plus $60.00 regardless of your balance |

| PLUS Investment Fees and Costs | 0.65% p.a. | AND, you will be charged or have deducted from your investment $325.00 in investment fees and costs. |

| PLUS Transaction Costs | 0.09% p.a. | AND, you will be charged or have deducted from your investment $45.00 in transaction costs. |

| EQUALS Cost of product2 | $520.00 p.a. | If your balance was $50,000 at the beginning of the year, then for that year you will be charged fees of $520.003 for the superannuation product. |