Investor – Autumn 2019

Bringing you market news and investor insights

Why ‘Keep Calm and Carry On’ should be your investment mantra

Investing can be an emotion-driven game. So, with market volatility likely to continue in 2019, how do you arm yourself with the right knowledge to make sound investment decisions and not let your impulses get the better of you? The key is mastering our instincts and regaining control over our impulses, making the old adage ‘Keep Calm and Carry On’ a good rule of thumb when it comes to investment strategy.

To be a successful investor, it is important to be objective and disciplined when making investment decisions. This means making sure decisions align with your long-term goals. While you would be forgiven if tightening US monetary policy, global trade war escalation, budget conflict between Italy and the European Union, and uncertainty over Brexit prompted you to second guess your investment strategy, making changes off the back of these events can lose you money in the long run.

To better understand and overcome our emotional and behavioural biases, we need to learn to identify when we are about to make a decision based on feelings rather than facts.

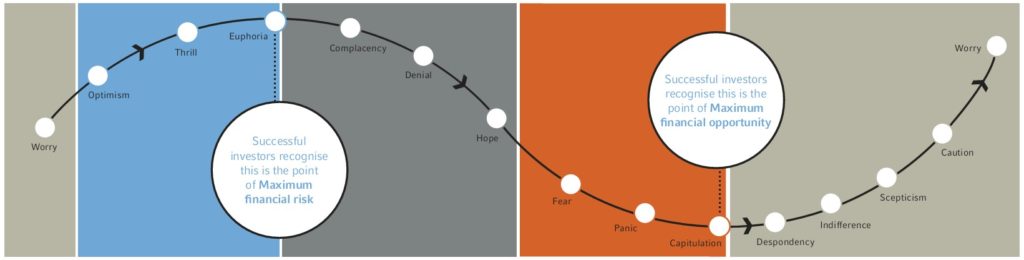

The four stages in the cycle of ‘market emotions’ shown below correspond to four common behavioural biases that we see as individuals try to make investment decisions. By analysing these biases, we have identified some tips to help you stay on track with your long-term investment goals.

The ‘thrill’ of the ride

You hear ‘resource boom’, ‘tech boom’, ‘credit boom’ – and you want to take advantage, even if it means abandoning your long-term investment strategy. Sounds familiar? This is called ‘optimism bias’. This ‘glass half full’ approach to investing causes us as emotional beings to overestimate the probability of positive outcomes occurring (i.e. gains) and underestimate negative ones (i.e. losses).

Camp denial

Ever chosen the same numbers in Lotto because they won the first time? Or perhaps you switched your investment strategy in the past and it worked for you, so you want to do it again? We make decisions like this because of something known as ‘anchoring bias’. Anchoring, or relying too heavily on a past reference to make decisions, has a powerful impact on the choices we make. It often leads us to act on our first thought, idea, or offer, rather than considering our options more thoroughly and thoughtfully.

Meet fear and panic

There have been few events that shook investor confidence as much as the 2007 Global Financial Crisis. In the years that followed, we saw investors afflicted by a phenomenon called ‘loss aversion’, where they were willing to do anything to avoid taking another hit. While it is normal to feel nervous in these situations, as investors, we need to remember that ‘bad’ years and losses are normal. It is also important to remember that our brains are good at tricking us into thinking we are losing more often than we are gaining.

Proceed with caution

Now you’re at the end of the cycle of emotions and you might be feeling rather indifferent and full of caution. You feel as if you’d rather not make any change to the way you’re invested, because you’re worried any revision could only lead to losses. This could be a sign that you’re in the grip of ‘status quo bias’—a reflection of human aversion to change. It’s a natural reaction to want to leave things as they are; where it feels easier to lie low and do little to nothing. It’s like choosing to go with a default investment strategy, when you also have the opportunity to make an active choice based on your retirement goals and income expectations, which in turn could lead to improved outcomes.

A wise investor is a calm investor

Markets move, and investments will always go in and out of favour. We can be responsive and keep our finger on the pulse without being reactive and riding every wave. Sometimes it’s the decisions you choose not to make that count more.

By taking the time to reflect on why you make the financial decisions that you do, you are better able to master the instincts and biases that could be losing you money.

So, next time you notice yourself wanting to make an impulse decision about your investment strategy, we encourage you to ‘Keep Calm and Carry On’.

We’re here to help

Have a question about your investment strategy? Give us a call on 1800 025 241. We’re happy to have a chat.

Expert help for a great life after work

You can never have enough good advice. And when it’s all about you, comes without surprises or jargon, and involves trusted and experienced experts, financial advice can make a real difference in securing your financial future. As a member you have access to general advice, Retire Ready consultations, phone-based advice and comprehensive advice. It depends on your circumstances.

What’s more, no matter which one you choose, you will have a trusted partner to not just manage the paperwork, but also interpret the advice. And the best part? Most of it comes at no cost to you. Want to know more? Call us today on 1800 025 241.